Targeting 50 Years of Wealth Creation

A journey of a thousand miles begins with a single step. - Laozi

About MX Capital

MX Capital is a private investment management company based in Sydney, Australia. MX Capital was founded to deliver a Vision: superior investment return over a long period by focusing on socially responsible investment opportunities.

MX Capital adopts a high conviction, fundamental-based investment philosophy, invests predominantly in growth businesses not well recognised by the market.

Why we are different

50-year Investment Horizon

- MX Capital is founded to target 50 years of significant wealth creation

- MX Capital's private ownership permits long-term thinking

- Founder's Chinese cultural background enables a very long-term focus

Focus on driving performance, not asset gathering

- 7.5%^ absolute return performance fee hurdle, a hurdle that approximates long-term index return

- $100M soft-close limit to leave ample performance run-way

High value-add investment philosophy

- High Conviction concentrated portfolio

- Value-accretive Growth backing great businesses

- Time-arbitrage to exploit market short-termism

- Ethical investing to avoid stranded asset risk

- Buy once, sell once no unnecessary trading

Significant alignment of interest

- >95% of the Founder’s liquid wealth in the strategy

- No personal trading

^ 7.5% performance fee hurdle consists of: 6% performance fee hurdle, 1.2% management fee and 0.3% of estimated cost recovery at scale.

The People

WEIMIN XIE

Chief Visionary Officer, Portfolio Manager

Weimin has over 16 years direct experience in the Australian small to mid-cap equity market.

Before establishing MX Capital, Weimin worked for Ophir Asset Management as a portfolio manager for three years, where he was actively involved in the establishment and management of the highly successful Ophir High Conviction Fund. Weimin was an integral part of the success of Ophir, having participated in its growth from humble beginnings to over $600M^^ funds under management prior to his departure in August 2017.

Before Ophir, Weimin worked for Kosmos Asset Management for seven years, as an equity analyst. Kosmos is a boutique equity fund manager specialising in Australian small-cap equities, having achieved above 20% p.a.* gross return for the 5 years ending December 2013. Weimin was a key team member in Kosmos' successful growth from inception to over $600M ** funds under management.

Weimin was born in Guangzhou, China, with the ability to speak fluent Cantonese and Mandarin. Weimin came to Australia to attend high school and subsequently graduated from the University of New South Wales with a Bachelor of Commerce (Hons) in Actuarial Studies and a Bachelor of Science in Computer Science. Weimin is a Fellow of the Institute of Actuaries Australia (FIAA), a Chartered Enterprise Risk Actuary (CERA) and a Chartered Financial Analyst (CFA).

KELLY LIN

Office Manager

Kelly is responsible for assisting in the running of the business. Kelly has a background in public accounting practice which covers accounting and taxation services to individuals, companies, trusts, partnerships, superannuation funds and audit. Kelly graduated from the University of Sydney with a Bachelor of Commerce in Accounting and Management, and a Master of Financial Analysis at the University of New South Wales. Kelly is a Chartered Accountant (CA).

Weimin is also supported by an external compliance consultant in fulfilling its compliance requirements.

^^ The Australian 7 March 2017. * Mercer Multi-Manager Quarterly Report December 2013, return for the 5 years ending December 2013. ** The Australian Financial Review 22 July 2014.

Subscribe

Please subscribe to our quarterly update here.

Investment Philosophy

MX Capital believes great investment ideas do not come often. Only a concentrated high conviction portfolio could provide enough capital to justify these great ideas. MX Capital's portfolio typically consists of 15-20 stocks, but adequately diversified across sectors.

MX Capital's main investment style is Growth at Reasonable Price. MX Capital aims to hold a value-accretive growth business for as long as the business economy stays sound and the valuation is not excessive. MX Capital typically look at a business' potential over a 3-5 years time horizon.

MX Capital defines risk as the "permanent loss of capital", not volatility of the share price. MX Capital considers the best way to manage risk is to know what you are doing.

Investment Style

Broadly, MX Capital's investments can be classified into three types, with their characteristics described below:

Structural Growth

(Warren Buffett approach)

- Look for >20% return on incremental capital deployed

- Significant growth potential

- Honest, competent, energetic management

- Solid balance sheet

- Fair valuation for the growth and quality of the business

Accelerated Growth

(Peter Lynch approach)

- A stock typically has a chequered history

- A clear signal of an acceleration of business momentum

- Perceived risk is high, and many things are unclear

- Valuation goes from fair to high to market darling status

- Likely to see a prolonged period of consolidation after the peak

Value Portfolio

(the boring approach)

- Real profitable businesses

- Cheap without much debt

- Out of flavour small cap stocks

Investment Process

MX Capital's initial investment strategy is Australian and New Zealand listed small-cap equities. Based on the Founder's 12 years' experience and observations in this market, the Founder's have developed one important investment insight:

Buy Once, Sell Once.

Similarly to Warren Buffett's punch card investing, by practising Buy Once, Sell Once, MX Capital is aiming to achieve a better overall investment performance at a reduced level of trading. MX Capital's investment process is designed around this insight, the key elements include:

Fast Turnaround Time

- A comprehensive idea generation system;

- A fast system to make quick decisions, which is highly important when the investment universe is close to 2000 stocks;

Detail Analysis

- A system to conduct wide-ranging information gathering, including company visitations and channel checks;

- Utilising multiple financial analysis frameworks and valuation methodologies are used to analyse a stock;

- A comprehensive checklist covering more than 100 items to eliminate any personal bias and blind spots;

Strict Risk Management Process

- Strict portfolio limits enforced

- Carefully designed system to manage risk of "permanent capital loss", not daily price fluctuation

Ethical Investing

Why Ethical?

Ethical investing is necessary to deliver a high long-term return, it adds to performance, not detraction!

- Avoid inherent risks associated with unethical investments that are difficult to assess:

- Market does not price risks that are difficult to assess;

- Unethical assets likely become stranded as social, government and technology changes create constant pressure over a 50-year time horizon.

- Sharpen focus on investment universe that performs better:

- Negatively screened stocks return 10% over last 5 years to June 2017, vs. ASX total return of 61%. In small-mid cap space negatively screened stock return is negative double-digit;

- During the same period, ethical industrials stocks offer 20x higher chance of producing a stock returning 25% p.a. than negatively screened stocks

- Morally it's the right thing to do; ethical investing is more enjoyable:

- Enjoyment helps the Founder to maintain a long-term commitment to the Vision.

Ethical Investment Process

MX Capital uses a negative screen to exclude companies that have direct or material involvement in the following (defined as more than 10% of combined revenue):

Damaging to human society:

- Weapons or weapon components capable of mass killings, such as nuclear, biological weapons;

- Tobacco;

- Gambling;

- Companies that entice people into financial over-commitment.

Violation of animal rights:

- Cruel and intensive animal farming;

- Animal testing for cosmetics.

Human rights violations:

- Child labour;

- Other human rights violation behaviours.

Unremediated destruction of the environment:

- Environmental destructive uranium mining;

- Nuclear reactor with improper disposal of waste materials;

- Exploitation of old-grown forest;

- Production of environmentally damaging harmful product;

- Fossil fuel exploration and production that causes global warming.

The ethical screen is subject to change without notice as to adopt for the development of our society. Please contact MX Capital for the latest criteria.

Subscribe

Please subscribe to our quarterly update here.

Fund Performance

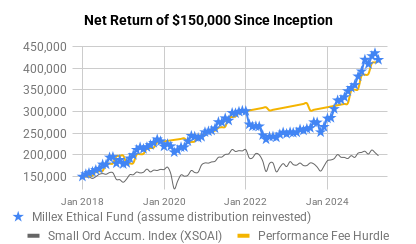

As at 30 June 2024, the Millex Ethical Fund has returned 13.8% p.a. return net of all fees and costs since inception on 1 January 2018. The S&P/ASX Small Ordinaries Accumulation Index (XSOAI) has returned 3.9% p.a. during the same time period. The outperformance is 9.9%.

Request latest unit price estimate.

Quarterly Updates

How to Invest

Please subscribe to our quarterly update and choose to request an Information Memorandum.

Contacts

MX Capital Pty Ltd

Address: Suite 202, 23 Hunter St, Sydney, NSW 2000

Email: invest@mx.capital

Phone: +61 2 8006 1388

Apex Group, formerly Mainstream Fund Services (Administrator)

Postal Address: GPO Box 4968, Sydney, NSW, 2001

Email: InvestorServices@apexgroup.com

Phone: +61 2 8259 8550

MX Capital Pty Ltd (AFSL 503 230) is authorised to provide advisory, dealing, and custodial services in connection with the Millex Ethical Fund to wholesale clients only.

Copyright MX Capital Pty Ltd 2017-2024 - All Rights Reserved - Privacy Policy